Telematics: Improve your driving and lower your premium!

Are you preparing for Exam 5 and want to learn more about telematics? Or do you just want to learn more about this popular trend in the auto insurance industry? Read below for more information!

Telematics for Auto Insurance: What is it?

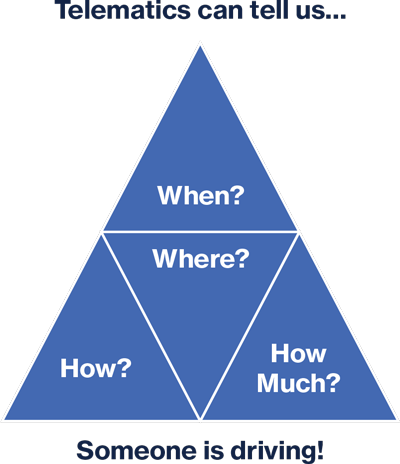

You might have heard about usage-based insurance (UBI) from commercials or online ads — maybe you’ve seen an ad that tells you if you install a device in your car or download an app, you can be rewarded for safe driving in the form of premium discounts. Using data captured from this device, an insurer can collect information about driving behaviors such as braking, mileage, location and even the time of day that you are driving. But how does this work, and what are the incentives for insurers and drivers?

What can we do with driving data?

If we already have rating factors, why do we need driving data? In many ways, rating factors can be thought of as proxies for driving behavior. For example, let’s look at driver age. It’s a much-known fact that younger drivers (especially teenagers and those in their early 20s) are often charged a higher premium for their car insurance because they are seen as riskier. This may seem like an obvious question, but why? What is it that makes younger drivers riskier? It is not their age alone but also the driving behaviors that might be more commonly associated with their young age and less driving experience — perhaps younger drivers tend to brake more harshly and more frequently, for example. With telematics we can take out this guess work and use actual driving behaviors to assess a driver’s level of risk. In this example, telematics allows us to observe how younger people drive — all else being equal, those that drive more safely might be eligible to receive a lower premium than their riskier counterparts.

What does this mean for insurers?

Insurers can create models to tie this driving behavior back to actual insurance losses and see what behaviors are associated with losses. This enables an insurer to offer discounts and premiums that better reflect a driver’s true level of risk. This can help insurers retain less risky drivers and improve their profitability. Because many telematics programs also offer some sort of driver feedback (such as encouraging a driver to brake less harshly), an insurer might also see fewer losses coming in.

Telematics also allow insurers to offer more products and choices to their insureds. Many insurers offer traditional policies in addition to telematics programs, so the choice to sign up for such a program is often that — a choice, not a requirement. Some insurers also offer pay-per-mile programs where an insured pays for each mile they drive (as tracked by the telematics device). These programs are often popular with drivers who have low annual mileage.

What does this mean for drivers?

While some drivers may be reluctant to allow their driving to be monitored, the goal of telematics is fairness in pricing — telematics allows an insurer to observe individual driver behavior and price accordingly. As mentioned above, rating factors are often proxies for actual driving behavior. With this more granular information, the goal is that an insured can receive a premium that is more commensurate with their true level of risk. Since many telematics apps also show a score and information about driving behaviors, an insured can also see what they can do to improve their score and become a better driver. This adds an element of transparency and controllability to the telematics program.

Telematics: Is it the future of auto insurance?

Telematics programs are certainly increasing in popularity with both insurers and drivers, but only time will tell if they eventually become the industry norm. For now, a telematics program can be a great choice for an insurer who is looking to add some breadth to their product offering (and possibly improve their loss ratio) or for a driver who wants to save some money and maybe even learn to drive more safely.