Request for Proposals - CAS Seeks Research on Hurricane Mitigation Premium Credits

Proposal Deadline: July 7, 2025

The Casualty Actuarial Society (CAS) is offering up to $45,000 to fund research quantifying quantifies the impact of hurricane mitigation measures and associated premium credits.

Research Problem Description

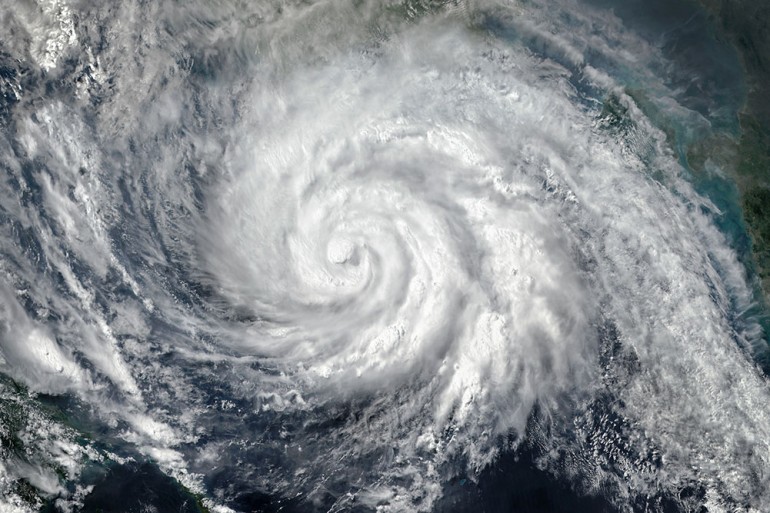

Six of the ten of the most expensive hurricanes, resulting in more than $230 billion in insured losses, occurred during the past decade. Changing climate conditions and growing population density in hurricane-prone regions necessitate a thorough quantification of the impacts of various mitigation efforts, such as premium credits. These efforts can benefit insurers and customers while inform public policy and safety decisions.

For example, Florida Section 627.0629(1) requires all residential property insurers to file premium credits for customers who install or implement windstorm damage mitigation — such as strengthening roofs, windows, doors and skylights as well as roof-to-wall and wall-to-floor-to-foundation reinforcement.

Pursuant to the statute, the Florida Office of Insurance Regulation (OIR) determines credits for the mitigation measures and secondary characteristics that insurers may use in rate filings. While the current credits are based on a 2008 study, an updated study was released in June 2024. Damage ratios for hurricane mitigation measures and secondary characteristics are also required in hurricane catastrophe model submissions to the Florida Commission on Hurricane Loss Projection Methodology.

While there is ample detail available on damage ratios and premium credits for the hurricane mitigation measures and secondary characteristics prescribed by Florida statute, there are several problems with the implementation of windstorm mitigation credits in the current ratemaking process.

To broaden the available material on detailed alternative studies of hurricane mitigation premium credits, researcher(s) will develop new or substantively adapt existing frameworks that can be integrated into residential and/or commercial property insurance pricing.

The research report might:

- Explore the need for consistency in catastrophe models used to perform the quantification of mitigation efforts with those for estimating loss costs;

- Consider whether the premium credits provided by an insurer are reflected in the corresponding cost of reinsurance for catastrophe exposed business;

- Outline actuarial considerations and approaches for developing hurricane mitigation premium credits;

- Describe challenges in obtaining data and implementing hurricane mitigation premium credits; or

- Illustrate the concepts through case studies based on specific communities representing a significant concentration of hurricane risk.

Proposal Requirements

The proposal should propose new or substantively adapt existing frameworks for hurricane mitigation premium credits that could be integrated into residential and/or commercial property insurance pricing for hurricane-prone states.

The proposed framework(s) for mitigation premium credits should be:

- Structured and parameterized to comply with ratemaking requirements in Florida and hurricane-prone other states

- Flexible enough to adapt to the evolving nature of hurricane risk over time

- Potentially applicable to a wide range of property pricing use cases, and

- Rooted in established actuarial ratemaking and catastrophe modeling principles.

Additionally, the credits should be explainable to insurance industry decisionmakers who may not have actuarial or catastrophe modeling education or experience.

Material assumptions, limitations and uncertainties should be clearly communicated and quantified where appropriate.

In addition to a CAS-published research paper, the selected researchers must deliver a two- to three-page executive summary suitable as a blog post or magazine article. This summary should highlight the key takeaways from the paper and be understandable by a non-technical audience.

This paper is a sample of the type of end product the CAS is seeking: Catastrophe Models For Wildfire Mitigation: Quantifying Credits And Benefits to Homeowners and Communities

Submitting Proposals

Interested researchers should submit a proposal that includes:

- A detailed outline and research approach.

- Labor expenses commensurate with the time required and other out-of-pocket expenses that should not exceed $45,000.

- Resumes of the researcher(s), indicating how their background, education and experience demonstrate their qualifications to perform the research.

- Acknowledgement that authors must report the use of artificial intelligence, if any, while producing research.

Interested parties are welcome to submit questions about the RFP. All questions and responses will be circulated to those respondents who have submitted questions or who have expressed their intent to submit proposals by June 15, 2025. Submit questions and proposals to Olivia Curtis (ocurtis@casact.org), Program Coordinator, and copy to Joyce Warner (jwarner@casact.org), Chief Business Officer. “Hurricane Mitigation Premium Credits Proposal” must be in the subject line.

A CAS contract will be awarded to the researcher(s) who, in the judgment of the Climate and Sustainability Working Group, can best perform the specified work. If the group determines that no proposal meets the requirements of the RFP, no contract will be awarded.

Presentation, Ownership and Publication of Report

Upon selection, the researcher(s) must sign a formal research agreement that assigns all rights, title, and interests, including copyright and patent rights of the report will be owned by the CAS. In any publication of the report, the researcher(s) will receive appropriate authorship credit.

Authors will be required to upload their final paper electronically in the CAS’s Scholar One system. To aid research adoption, the final work product’s code and data will also be placed in the CAS’s GitHub repository, https://github.com/casact, under the MPL2.0 license. Researcher(s) should make every effort to be available to present the report at a CAS meeting or seminar.

Timeline

| May 15, 2025 | RFP Announcement |

| July 7, 2025 | Proposals Due |

| August 2025 | Selection |

| December 2025 | Completed Project Deadline |

About the Casualty Actuarial Society (CAS)

The Casualty Actuarial Society (CAS) is a leading international organization for credentialing and professional education. Founded in 1914, the CAS is the world’s only actuarial organization focused exclusively on property and casualty risks and serves over 11,000 members worldwide. CAS members are experts in property and casualty insurance, reinsurance, finance, risk management, and enterprise risk management. Professionals educated by the CAS empower business and government to make well-informed strategic, financial and operational decisions. To expand and enhance the skills of modern actuaries, the CAS supports research in a variety of areas.

About the Climate and Sustainability Working Group

The Climate and Sustainability Working Group addresses actuarial issues related to climate risk and sustainability within the Property-Casualty sector. It is a cross-functional body, providing guidance on climate and sustainability-related research, professional education, and outreach.